I can help you conduct econometric analysis using SAS and write report

- 4.7

- (5)

Project Details

Why Hire Me?

📱Click to Connect on Whatsapp to Discuss Your Project

With over 7 years of experience as a data analyst, I specialize in using SAS for econometric modeling across various sectors. I transform raw datasets into structured, reliable analyses using advanced regression, time-series, and panel data techniques, ensuring you receive actionable insights and well-crafted reports.

Key Strengths:

-

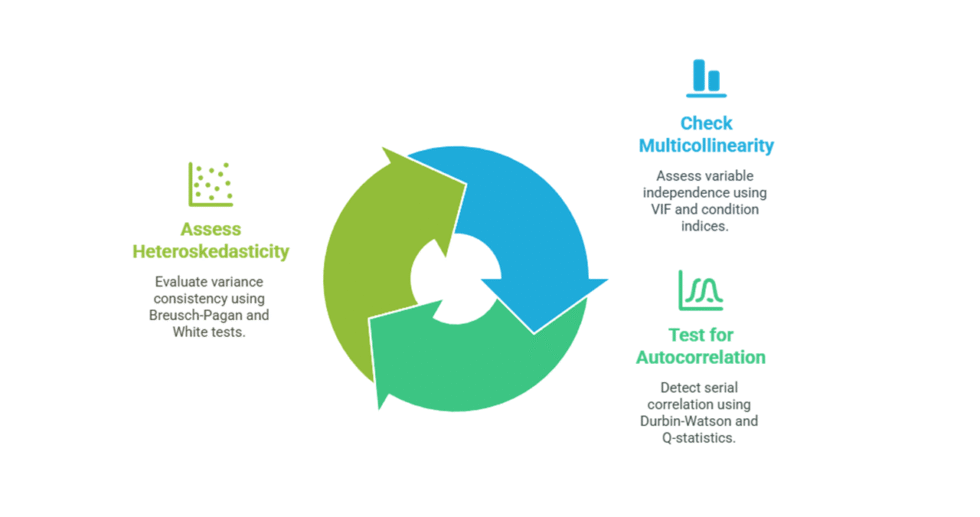

Expert in SAS procedures for REG, LOGISTIC, ARIMA, TSMODEL, and PANEL

-

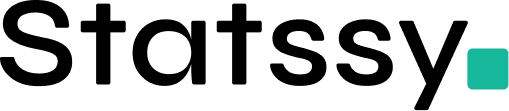

Skilled in SAS data handling, diagnostics (multicollinearity, autocorrelation, heteroskedasticity), and model testing

-

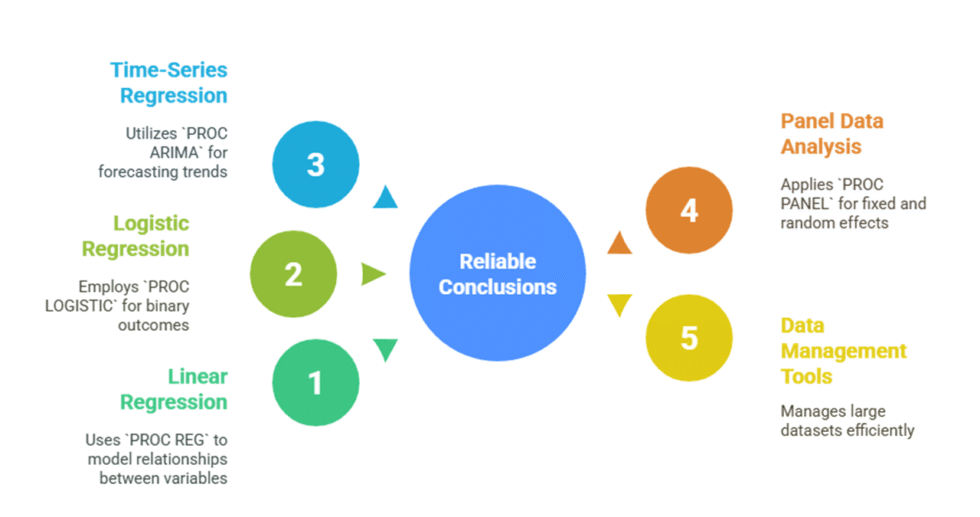

Strong visualization and reporting skills using ODS Graphics, PROC SGPLOT, and PROC REPORT

-

Extensive experience with datasets in healthcare, policy, banking, retail, and academic economics

-

Final deliverables formatted in APA/Harvard/IEEE or tailored to your organization's requirements

-

Strong ability to translate statistical findings into plain-language insights for stakeholders

What I Need to Start Your Work

To ensure smooth and targeted delivery, please provide the following details:

-

Project Details

-

The objective and scope of your econometric task

-

Key hypotheses or research/business questions

-

-

Data Files

-

Compatible formats:

.sas7bdat,.csv,.xlsx -

Dataset documentation, variable types, any preprocessing already performed

-

-

Econometric Methods Required

-

Specific techniques or models (e.g., time-series, cross-sectional regression, fixed/random effects)

-

Preferred SAS procedures or functions if any (e.g.,

PROC REG,PROC AUTOREG)

-

-

Report Preferences

-

Academic or business tone

-

Expected sections (e.g., model output, interpretation, recommendations)

-

Graphs, tables, and visual output expectations

-

-

Delivery & Communication

-

Preferred communication channel and update frequency

-

Important deadlines or delivery milestones

-

Portfolio

SAS Panel Regression Evaluated Minimum Wage and Employment Relationship

Applied fixed-effects panel regression in SAS to measure the effect of minimum wage increases on employment rates across U.S. states. Results informed labor policy assessments and business impact forecasts.

Used SAS Time Series Econometrics to Analyze Stock Return Volatility

Developed an ARIMA-GARCH model in SAS to forecast return volatility in U.S. tech stocks. Analysis supported portfolio risk management and improved volatility-adjusted investment strategies.

SAS Econometric Model Linked Health Spending to Outcome Efficiency

Used SAS cross-sectional regression to analyze how healthcare spending correlates with health outcomes across OECD countries. Findings informed benchmarking and strategic policy planning.

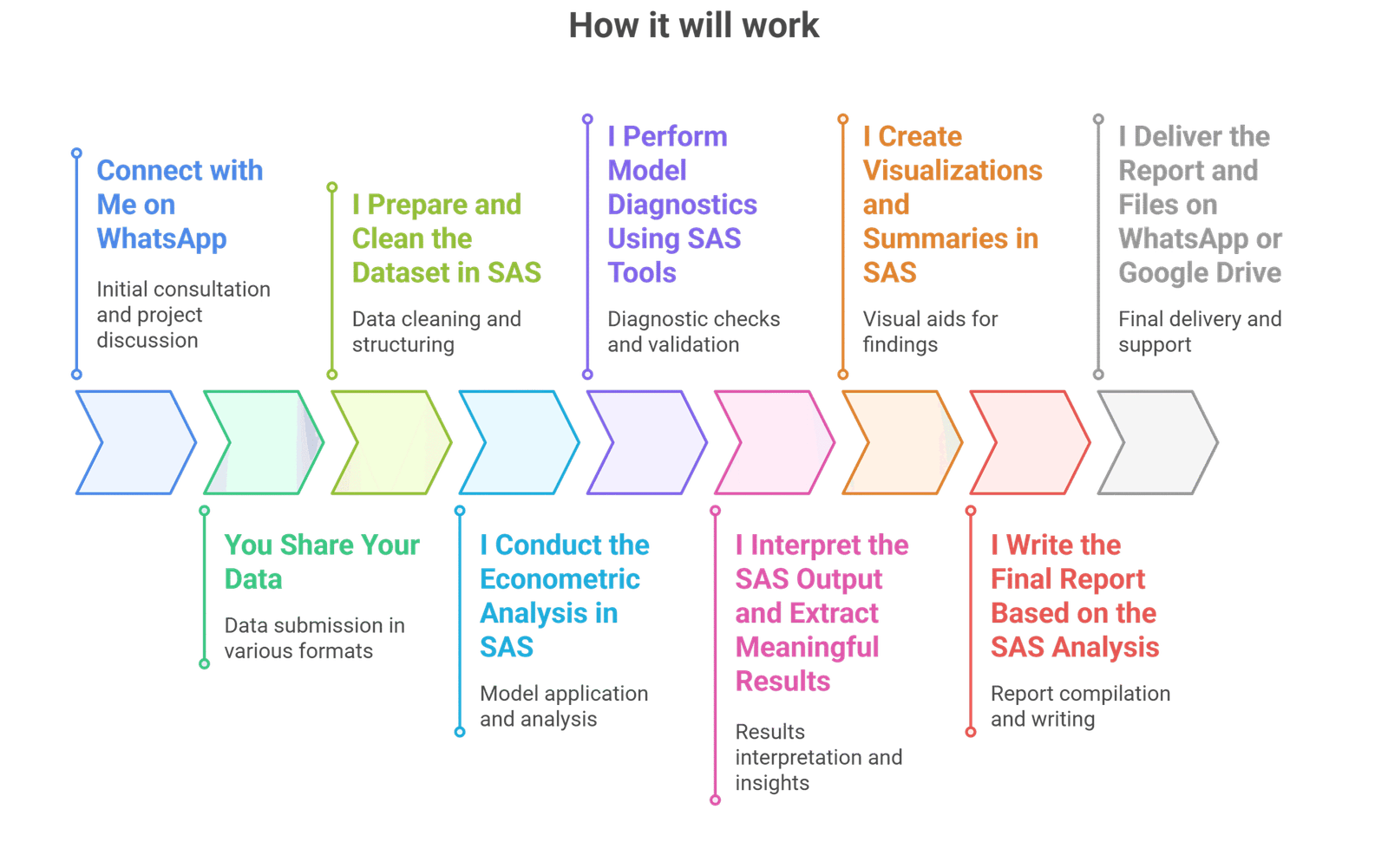

Process

Customer Reviews

5 reviews for this Gig ★★★★★ 4.7

SAS report was comprehensive with proper multicollinearity and residual analysis. he also explained how the PROC REG results were interpreted

the model diagnostics and visual output were done nicely. I asked for Harvard style and he formatted everything correctly. delivery was one day early

I needed help with a time series project and he delivered the results in SAS with clear steps. even added comments in the code so I could learn from it

handled ARIMA forecasting in SAS really well. few formatting issues in the first draft but the model output and interpretation were spot on

he used SAS to analyze my healthcare data with logistic regression. report was clear and included charts that made things easier to explain to my professor